-

بررسی آییننامهها و دستورالعملهای برنامه هفتم پیشرفت

-

بررسی عوامل موثر بر افزایش تصادفات و تلفات جادهای و سوانح رانندگی و دادهکاوی تلفات انسانی

-

سازماندهی و بازآرایی فضایی آموزش عالی کشور

-

به روز رسانی سند ملی آمایش سرزمین

-

انجام مطالعات مناطق آزاد به عنوان نواحی پیشران اقتصادی کشور

-

اصلاح ساختار بودجه و پیاده سازی نظام یکپارچه مدیریت اطلاعات مالی دولت (IFMIS)

کلید واژه : Financial system

تعداد اخبار : 5

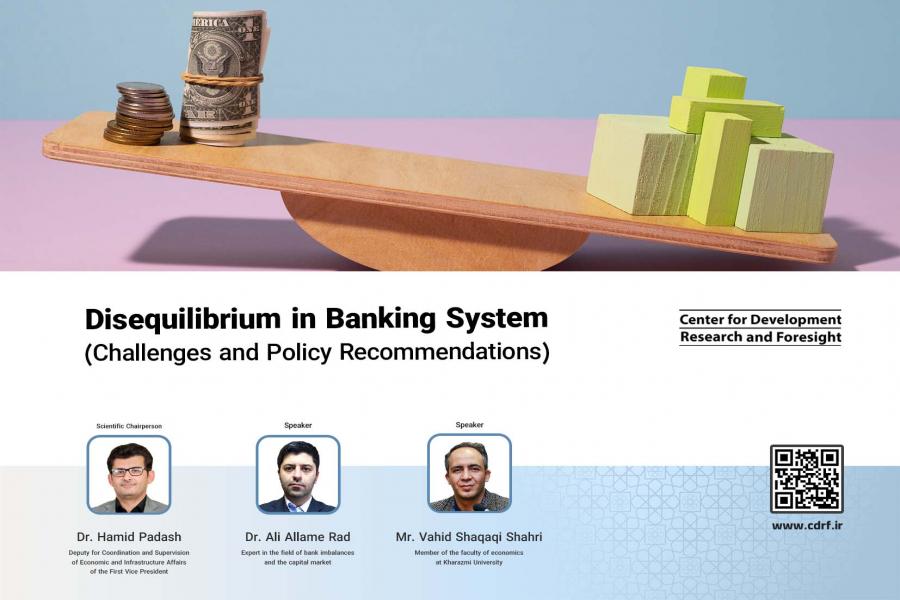

Disequilibrium in Banking System: Challenges and Policy Recommendations

The banking sector's disequilibrium has emerged as a pervasive and enduring challenge within the nation's macroeconomic framework. A series of strategic missteps have plagued the banking sector over the preceding four decades, including: the absence of unified Central Bank oversight from the late 1960s until 1994, despite formal recognition (substantive supervision remained deficient), the premature privatization of the banking industry without adequate national economic preparation, the imposition of government expenditures on private and non-governmental banks, particularly to offset a portion of the budget deficit, the perpetuation of a traditional view of money as a private commodity (a primary factor exacerbating domestic inflation), and vacillation between disparate economic schools, shifting from socialist to capitalist ideologies.

Assessing the Impact of Tax Exemption for Bank Deposit Interest on Iran's Banking System

The exemption of bank deposit interest from taxation within Iran’s financial system is a topic of considerable debate in this field. This research investigates whether the tax on deposit interest should be regarded as an integral component of the tax system or if it should continue to be exempt. Addressing this question, which forms the crux of this study, necessitates a comprehensive review of tax literature, the structure of Iran’s tax system, and its economic, social, and political conditions. This research adopts a three-step approach to address the issue of exempting bank deposit interest from taxation.

Artificial Intelligence and its role in the Development of Financial Systems and Budgeting

Artificial intelligence (AI) has emerged as a transformative technology, extensively studied and developed over the past seven decades. Its growing prominence has rendered it an indispensable tool for governments worldwide. While AI's potential to enhance decision-making power and quality remains an ongoing area of inquiry, its application in certain policy domains, such as public budget drafting, has received limited attention. This paper delves into the untapped potential of AI in budget allocation, a critical aspect of financial policy.

The Importance of Data Mining in Financial Transparency

The recent conference at the Center for Development Research and Foresight brought together experts to discuss how data governance and mining can improve the country's budgeting process. The conference was part of an ongoing series aimed at improving budget transparency and efficiency.